Real-time Fraud Detection Engine

Preventing fraudulent transactions while minimizing false positives

Key Results

SecureBank Financial is a leading financial institution serving over 5 million customers with a full range of banking and payment services.

SecureBank was facing increasing fraud attempts across their digital banking platforms. Traditional rule-based fraud detection systems were generating too many false positives, causing legitimate transactions to be declined and creating customer frustration. Meanwhile, sophisticated fraud techniques were still slipping through, resulting in significant financial losses and damage to customer trust.

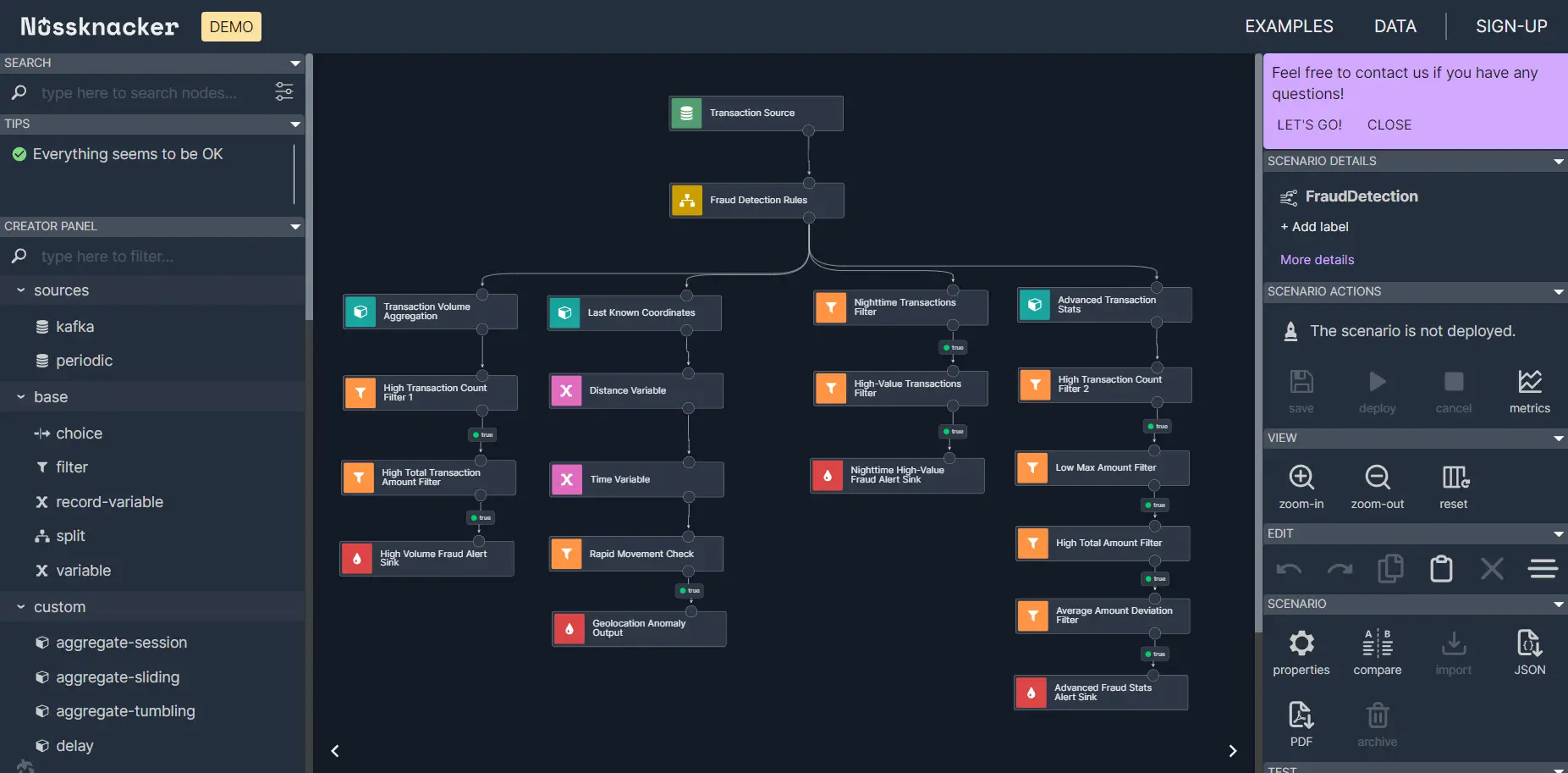

Cattt AI Studio developed a real-time fraud detection engine that uses advanced AI to identify fraudulent activities while minimizing false positives. The solution includes: 1. Machine learning models trained on historical transaction data 2. Behavioral analysis that establishes normal patterns for each customer 3. Real-time risk scoring for every transaction 4. Adaptive authentication based on risk level 5. Continuous learning system that improves over time

Our Process

Data Analysis & Feature Engineering

Analyzed historical fraud data and developed relevant features for the models

Model Development & Training

Created ensemble models combining multiple machine learning approaches

Integration & Testing

Integrated with banking systems and tested against known fraud patterns

Deployment & Optimization

Deployed in production with continuous monitoring and optimization

"The fraud detection engine has dramatically reduced our fraud losses while improving customer experience. The system's ability to distinguish between legitimate and fraudulent transactions is remarkable."

David Thompson

Head of Security, SecureBank Financial

Technologies Used

Related Case Studies

Ready to Achieve Similar Results?

Let's discuss how we can help transform your business with AI solutions